alwepo.com, Insurance for Your Construction Equipment – As a crucial component of the construction industry, reliable equipment is paramount for success. Without it, projects can face setbacks, resulting in wasted time, resources, and financial losses. However, unforeseen events can pose significant risks to construction businesses, making insurance coverage essential for safeguarding against potential losses.

In this comprehensive guide, we’ll delve into the process of obtaining insurance for construction equipment, exploring the various coverage options available and providing valuable insights on finding the right insurer to meet your specific needs.

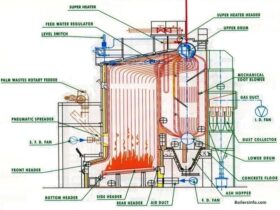

Understanding Construction Equipment Insurance

Construction equipment insurance serves as a vital safety net, offering protection against unforeseen events that could disrupt operations and incur substantial financial losses. Whether you’re tackling large-scale projects or smaller endeavors, insurance policies tailored for construction equipment provide comprehensive coverage for machinery and tools.

These policies typically include liability protection and compensation for damages resulting from incidents such as fires or floods. By securing adequate insurance coverage, small business owners can focus on business growth without the fear of having to rebuild from scratch following a significant incident.

Types of Coverage

Construction companies have two primary types of insurance coverage to choose from:

- General Liability Insurance: This coverage protects against various events, including injuries to third parties and property damage. It helps mitigate risks associated with potential lawsuits and medical expenses, providing crucial protection for construction businesses operating in diverse environments.

- Specific Risk Coverages: Tailored policies offer protection against specific risks such as fire and theft, extending benefits to cover these specific hazards and providing targeted protection against potential losses related to these risks.

Finding the Right Insurer

Finding the right insurer involves a strategic approach tailored to your specific needs. Here’s how to navigate the process effectively:

- Identify Your Needs: Assess the unique requirements of your construction business, considering factors such as project scale, industry type, and potential risks. Determine the types of coverage you need, whether it’s general liability, property insurance, or specialized coverage for equipment and tools.

- Seek Experienced Insurers: Look for insurance providers with a proven track record in insuring construction businesses. Seek out companies specializing in serving the construction industry and possessing experience handling the unique risks associated with construction operations.

- Consider Industry Expertise: Evaluate insurers based on their expertise in addressing construction-related liabilities, such as workplace accidents and property damage. An insurer with industry-specific knowledge can offer valuable insights and guidance in selecting the right coverage options for your business.

- Assess Budgetary Constraints: While prioritizing comprehensive coverage is essential, consider your budgetary constraints. Compare quotes from multiple insurers to find policies offering the best value for your money without compromising on coverage quality or customer service.

Common Risks to Construction Equipment

Construction equipment faces various risks, including natural disasters, vandalism, accidents, theft, fire, and wear-and-tear from regular use. Protecting these assets is crucial to ensuring operational efficiency, productivity, and profitability.

Insurance Policies for Peace of Mind

While cost concerns may deter some businesses from investing in insurance, alternative options exist to manage expenses. Some insurers offer discounts for the first year or cover deductibles, reducing out-of-pocket expenses for repairs and replacements.

Conclusion

With a solid understanding of how to obtain insurance for construction equipment, you’re equipped to protect your assets and mitigate risks effectively. By securing the right coverage and understanding policy limits, you can safeguard the longevity and success of your construction business against unforeseen events. Prioritizing insurance ensures peace of mind, allowing you to focus on growing your business with confidence.

.jpg)

Leave a Reply

View Comments