Purchasing a manufactured home is an exciting investment that offers comfort, affordability, and flexibility. As a responsible homeowner, it’s essential to safeguard your property against unforeseen events that could lead to financial losses. Homeowners insurance is a crucial component of protecting your manufactured home and its contents. In this comprehensive guide, we will delve into the ins and outs of homeowners insurance for manufactured homes, helping you understand the importance of coverage, its various aspects, and how to choose the right policy for your needs.

Understanding Manufactured Homes

Before diving into homeowners insurance, let’s grasp the concept of manufactured homes. Unlike traditional homes, which are constructed on-site, manufactured homes are built in a factory and then transported to their permanent location. These homes, also known as mobile or prefab homes, are assembled on a steel chassis and are designed to comply with federal building codes.

The Importance of Homeowners Insurance

Homeownership brings joy and pride, but it also comes with responsibilities. One such responsibility is protecting your investment with homeowners insurance. This type of insurance provides financial protection against various risks, including damage to your home’s structure, loss of personal belongings, liability claims, and more. Without adequate coverage, you could face substantial financial burdens in the event of accidents, natural disasters, or theft.

Coverage Options for Manufactured Homes

When it comes to safeguarding your valuable investment in a manufactured home, having the right insurance coverage is essential. Insurance policies for manufactured homes offer a range of coverage options to protect you from various risks and potential financial losses. Below are the primary coverage options typically available for manufactured homes:

a. Dwelling Coverage

Dwelling coverage is the foundational component of homeowners insurance for manufactured homes. This coverage protects the physical structure of your home itself, including its walls, roof, floors, and any built-in appliances. It guards against a variety of specified perils, such as fire, lightning, windstorm, hail, explosions, vandalism, and other named risks as outlined in your policy. In the unfortunate event of damage to your home due to these covered perils, dwelling coverage will provide the funds necessary to repair or rebuild the structure.

For instance, if a severe storm damages your manufactured home’s roof, causing water leaks and interior damage, your dwelling coverage will help cover the cost of repairs to the roof, ceilings, and any other affected areas, up to the coverage limit specified in your policy.

b. Personal Property Coverage

In addition to protecting the physical structure of your manufactured home, you also need insurance coverage for the belongings and personal items you have inside it. Personal property coverage comes to the rescue in situations of theft, damage, or destruction of your possessions due to covered events, such as theft, fire, or severe weather.

Your personal property coverage extends to a wide range of belongings, including furniture, electronics, appliances, clothing, and other personal items. If, for example, your manufactured home is burglarized, and valuable electronic devices and jewelry are stolen, your personal property coverage will reimburse you for the value of the stolen items, subject to policy limits and deductibles.

c. Liability Coverage

Liability insurance is a crucial aspect of homeowners insurance for manufactured homes, as it protects you from potential financial burdens resulting from third-party injuries or property damage that occur on your property. Accidents can happen, and if someone sustains an injury or their property is damaged while on your premises, they may decide to take legal action against you.

Liability coverage steps in to cover legal defense costs, settlements, or judgments if you are found legally responsible for the incident. This coverage not only protects your finances but also provides peace of mind, knowing that you have a safety net in case of unexpected liability claims. For example, if a visitor slips and falls on your icy front steps and decides to sue you for medical expenses and other damages, liability coverage will help cover those costs, up to the policy limit.

d. Additional Living Expenses (ALE) Coverage

In unfortunate circumstances where your manufactured home becomes uninhabitable due to a covered event, such as a fire or severe storm damage, ALE coverage comes into play. ALE coverage helps with the costs of temporary living arrangements while your home is being repaired or rebuilt.

For instance, if a fire damages your manufactured home to the extent that it’s not safe to live in, ALE coverage will assist with expenses for temporary accommodation, meals, and other necessities. This coverage ensures that you and your family can maintain a reasonable standard of living until your home is fully restored.

Factors Affecting Homeowners Insurance Premiums

Homeowners insurance premiums for manufactured homes are influenced by a variety of factors that insurance companies take into consideration when determining the cost of coverage. Understanding these factors is essential as they can impact the amount you pay for your insurance policy. Below are the key factors that affect homeowners insurance premiums for manufactured homes:

a. Location

The location of your manufactured home is a significant factor in determining insurance premiums. Insurance companies assess the risk associated with the geographical area where your home is situated. Homes located in areas prone to natural disasters, such as hurricanes, floods, earthquakes, or wildfires, may face higher insurance premiums. Additionally, high-crime areas can also result in increased insurance costs, as there is a higher likelihood of theft and vandalism. On the other hand, homes located in low-risk areas may qualify for lower premiums.

b. Age and Condition of Home

The age and condition of your manufactured home play a role in calculating insurance premiums. Newer homes or those that have been well-maintained are generally considered to be less risky to insure. This is because newer homes are less likely to have structural issues or outdated systems that could lead to costly claims. As a result, owners of newer and well-maintained manufactured homes often benefit from lower insurance premiums compared to older or poorly maintained homes.

c. Coverage Limits and Deductibles

The coverage limits and deductibles you choose for your homeowners insurance policy directly impact your premiums. Coverage limits refer to the maximum amount the insurance company will pay for a covered loss, while deductibles are the out-of-pocket expenses you must pay before your insurance coverage kicks in. Opting for higher coverage limits or lower deductibles will generally result in higher insurance premiums. Conversely, selecting lower coverage limits or higher deductibles may lead to reduced premiums, but you’ll be responsible for paying more upfront in the event of a claim.

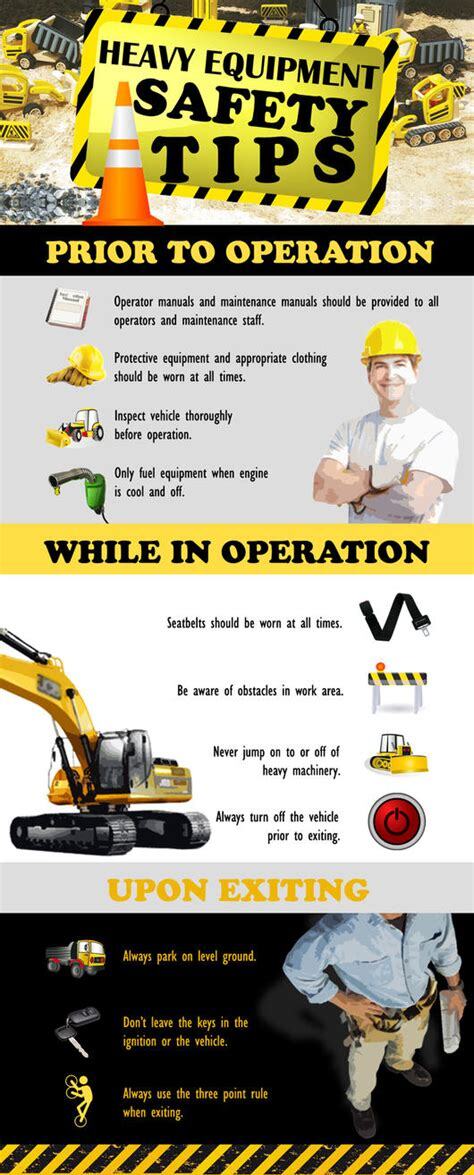

d. Safety Features

Investing in safety features for your manufactured home can have a positive impact on your insurance premiums. Insurance companies often offer premium discounts for homeowners who install safety measures that reduce the risk of damage or loss. Examples of safety features that can lead to premium discounts include smoke detectors, fire extinguishers, security systems, deadbolt locks, storm shutters, and other measures that enhance the security and safety of your home.

e. Claims History

Your claims history can also influence the cost of your homeowners insurance premiums. If you have a history of filing frequent insurance claims, insurance companies may consider you to be a higher risk customer. This can result in higher premiums as they may anticipate a higher likelihood of future claims. On the other hand, homeowners with a clean claims history may be eligible for lower insurance premiums as they are perceived as lower risk policyholders.

How to Choose the Right Policy

Selecting the right homeowners insurance policy for your manufactured home is a critical decision that requires careful evaluation of your needs and thorough research. Here are some essential steps to guide you through the process and ensure you make an informed choice:

a. Assess Your Needs

Before diving into the world of homeowners insurance policies, start by evaluating your needs and the unique aspects of your manufactured home. Consider the value of your home and its contents to determine the appropriate coverage amounts. Assess the potential risks and liability concerns associated with your property. For instance, if your home is located in an area prone to natural disasters, you may need additional coverage for such events. Take into account any valuable possessions or assets inside your home that might require specific coverage. Understanding your needs will help you tailor your policy to provide the level of protection your manufactured home requires.

b. Compare Quotes

Obtaining quotes from multiple insurance providers is crucial in finding the best policy for your manufactured home. Reach out to different insurance companies and request detailed quotes that outline the coverage options and corresponding premiums. When comparing quotes, ensure that the coverage limits, deductibles, and any additional benefits or riders are clearly stated. Comparing quotes will give you a comprehensive view of the available options, enabling you to choose the policy that strikes the right balance between coverage and affordability.

c. Read the Fine Print

When evaluating potential insurance policies, it’s essential to read the fine print carefully. Pay close attention to the policy’s terms, conditions, and exclusions to fully understand what is covered and what is not. Look for any specific limitations or circumstances under which the coverage may be denied. Understanding the fine print will prevent any surprises when filing a claim in the future. If you have any questions or uncertainties about the policy, don’t hesitate to reach out to the insurance provider for clarification.

d. Check for Discounts

Insurance providers often offer various discounts that can help lower your premiums. Inquire about any available discounts and see if you qualify for them. Common discounts may include multi-policy discounts (if you bundle your homeowners insurance with other insurance products), security system discounts, loyalty discounts for long-term customers, or discounts for being claim-free for a certain period. Taking advantage of these discounts can make your insurance coverage more affordable without compromising on the level of protection you need.

e. Review Customer Feedback

To gauge the reputation and customer service quality of insurance companies, research customer reviews and feedback. Look for reviews from other homeowners who have purchased insurance policies from the companies you are considering. Pay attention to any recurring themes or patterns in the feedback. Positive reviews regarding efficient claims processing, responsive customer support, and overall satisfaction are indicators of a reputable insurance provider. Be cautious of companies with consistently negative feedback and complaints about denied claims or poor service.

Filing Claims and the Claims Process

Experiencing damage or loss to your manufactured home or personal belongings can be distressing, but having a clear understanding of the claims process is crucial to ensuring a smooth and successful resolution. Here’s a detailed explanation of each step involved in filing a claim and what you can expect throughout the process:

a. Notify Your Insurance Provider

As soon as you discover damage or loss to your manufactured home or belongings, it is essential to act promptly and inform your insurance company. Most insurance policies have specific timelines within which you must report the incident to be eligible for coverage. Failure to notify your insurer within this timeframe may result in the denial of your claim. When reporting the incident, provide all relevant details and be prepared to answer any questions your insurer may have about the situation. Promptly notifying your insurance provider sets the claims process in motion and allows them to assess the situation quickly.

b. Document the Damage

Once you have reported the incident to your insurance company, it’s time to document the damage or loss. This step is vital to provide evidence for your claim and to support the assessment made by the insurance adjuster. Take photographs or videos of the affected areas, capturing the extent of the damage and any items that have been lost or destroyed. Ensure that the documentation is clear, detailed, and includes timestamps if possible. Additionally, if there were any factors that may have contributed to the damage (e.g., severe weather conditions), make a note of them. This documentation will help substantiate your claim and facilitate a fair and accurate evaluation by the insurance company.

c. Obtain Estimates

After documenting the damage, your next step is to obtain repair or replacement estimates from reputable contractors or vendors. Your insurance company may require you to obtain multiple estimates to compare and ensure that the proposed costs are reasonable and in line with the coverage provided by your policy. These estimates will serve as a basis for determining the amount of compensation you are entitled to receive. Make sure to choose reliable professionals to provide the estimates, as their credibility can impact the legitimacy of your claim.

d. Cooperate with the Adjuster

Once your insurance company receives your claim, they will assign an insurance adjuster to assess the damage. The adjuster is a trained professional who will visit your manufactured home, inspect the affected areas, and review the documentation you provided. During the inspection, it’s essential to be cooperative and forthcoming with the adjuster. Answer their questions honestly and provide any additional information they may request. The adjuster’s role is to impartially evaluate the situation and determine the extent of coverage applicable under your policy. Cooperating with the adjuster expedites the claims process and helps ensure a fair resolution.

e. Receive Compensation

After the assessment is complete, the insurance company will review the adjuster’s report and determine the coverage applicable to your claim. If your claim is approved, you will receive compensation based on the terms and conditions outlined in your policy. The amount you receive will depend on various factors, including the coverage limits, deductibles, and the extent of the damage or loss. In some cases, the insurance company may issue a payment directly to you. In others, they might pay the contractor or vendor providing the repair or replacement services. It is essential to carefully review the compensation you receive to ensure it aligns with your expectations and the coverage you are entitled to under your policy.

Conclusion

Owning a manufactured home offers many benefits, but protecting your investment is paramount. Homeowners insurance for manufactured homes provides the peace of mind you need to enjoy your home without constant worry. Understanding the different coverage options, factors affecting premiums, and the claims process will empower you to make informed decisions when selecting the right policy for your needs. Remember to regularly review your policy and make adjustments as needed to ensure continuous protection for your beloved manufactured home. Invest in comprehensive homeowners insurance today and safeguard your cherished dwelling against life’s uncertainties.

Leave a Reply

View Comments